Indirect Tax

Indirect Tax

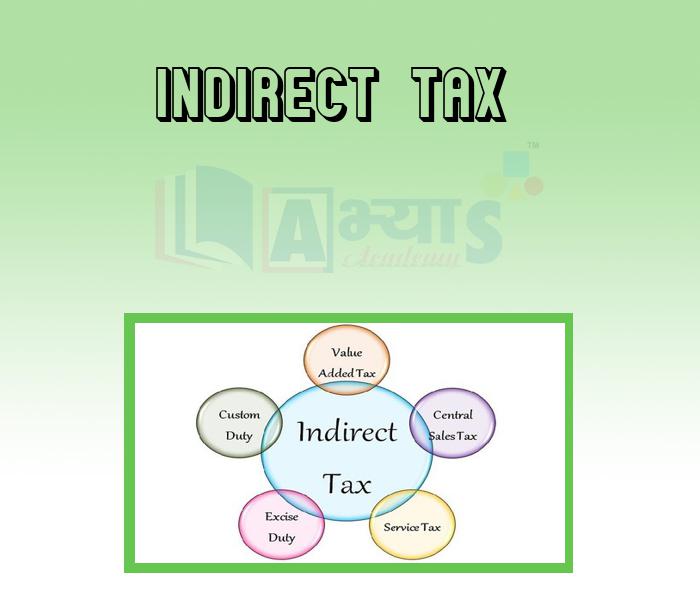

Indirect Tax: Until recently, the following indirect taxes (a - f) were being levied by Central and State governments. Most of these have since been subsumed in a single indirect tax known as GST (Goods and Service tax)

(a) Sales Tax: When you buy any commodity, you have to pay its cost price plus the sales tax. The manufacturer then pays the tax to the Government. In India, this kind of tax was paid to both the state government (Sales Tax) and the central government (Central Sales Tax), The sales tax was levied only on the intra-sale of commodities (sale within one state). The central tax was levied for inter-state sales (sales within states).

(b) Service Tax (GST): When you avail services, you have to pay tax and this is called service tax. This tax was introduced in 1994 and was applicable on every type of services, except the negative list of services, and was applicable in all the states, except Jammu and Kashmir.

(c) Customs Duty and Octroi: This tax is levied on the goods imported into the country as well as the goods that are exported to any other foreign country. It is charged at the entry point of the country, like airport, docks, etc. The octroi tax is levied on goods that are transported from one municipality to another.

(d) Excise Duty: The excise tax or the central value added tax is levied on the goods that are produced within the country.

(e) Anti Dumping Duty : When goods are exported from one country to another at a price that is lower than the actual price of that commodity, then the government charges anti-dumping duty on it.

(f) Value Added Tax (VAT): Value added tax (VAT) is a form of consumption tax. From the perspective of the buyer, it is a tax on the purchase price; from that of the seller, it is a tax only on the value added to a product, material or service; and, from an accounting point of view, it is a tax only at the stage of manufacture or distribution of product, material or service.

(g) GST (Goods and Service tax): The Goods and Services Tax (GST) is a Value Added Tax (VAT) recently implemented in India. It replaces most of the indirect taxes levied on goods and services by the Indian central and state governments.

Students / Parents Reviews [10]

My experience with Abhyas is very good. I have learnt many things here like vedic maths and reasoning also. Teachers here first take our doubts and then there are assignments to verify our weak points.

Shivam Rana

7thIt was a good experience with Abhyas Academy. I even faced problems in starting but slowly and steadily overcomed. Especially reasoning classes helped me a lot.

Cheshta

10thMy experience was very good with Abhyas academy. I am studying here from 6th class and I am satisfied by its results in my life. I improved a lot here ahead of school syllabus.

Ayan Ghosh

8thOne of the best institutes to develope a child interest in studies.Provides SST and English knowledge also unlike other institutes. Teachers are co operative and friendly online tests andPPT develope practical knowledge also.

Aman Kumar Shrivastava

10thAbout Abhyas metholodology the teachers are very nice and hardworking toward students.The Centre Head Mrs Anu Sethi is also a brilliant teacher.Abhyas has taught me how to overcome problems and has always taken my doubts and suppoeted me.

Shreya Shrivastava

8thBeing a parent, I saw my daughter improvement in her studies by seeing a good result in all day to day compititive exam TMO, NSO, IEO etc and as well as studies. I have got a fruitful result from my daughter.

Prisha Gupta

8thAbhyas Methodology is very good. It is based on according to student and each child manages accordingly to its properly. Methodology has improved the abilities of students to shine them in future.

Manish Kumar

10thA marvelous experience with Abhyas. I am glad to share that my ward has achieved more than enough at the Ambala ABHYAS centre. Years have passed on and more and more he has gained. May the centre flourish and develop day by day by the grace of God.

Archit Segal

7thIt has a great methodology. Students here can get analysis to their test quickly.We can learn easily through PPTs and the testing methods are good. We know that where we have to practice

Barkha Arora

10thI have spent a wonderful time in Abhyas academy. It has made my reasoning more apt, English more stronger and Maths an interesting subject for me. It has given me a habbit of self studying